What was the record high AM historical earnings result?

In terms of earnings or revenue, what is the best AM historical earnings result that Antero Midstream has ever posted, and when?

✔️Accepted answer:

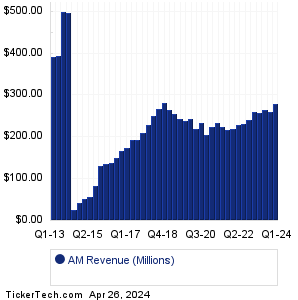

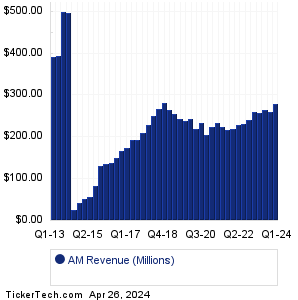

Within our data set, the highest AM historical earnings result was set in Q1 2014, when Antero Midstream posted results of 1.02/share. The most successful revenue quarter within our data set was Q3 2013 when Antero Midstream reported revenue of 499.40M.

What was the lowest Antero Midstream historical earnings result?

In terms of top line revenue or bottom line earnings per share, what was the lowest AM has reported, and when?

✔️Accepted answer:

Within our data set, the lowest AM historical earnings result was set in Q2 2013, when Antero Midstream posted results of -0.13/share. The smallest revenue quarter within our data set was Q3 2014 when Antero Midstream reported revenue of 0.03B.

On this page we presented the AM historical earnings date information for Antero Midstream. Reviewing that

AM Historical Earnings for the company, we see that the highest historical earnings result in our data set was in Q1 2014, when AM posted adjusted EPS of 1.02/share. Meanwhile the lowest AM historical earnings result was in Q2 2013, when AM posted adjusted EPS of -0.13/share. Moving to Antero Midstreams historical revenue numbers, the largest revenue quarter in our data set was seen in Q3 2013 when AM reported 499.40M in revenue, while the smallest revenue quarter was Q3 2014 when AM reported 0.03B in revenue.

For self directed investors doing their due diligence on AM or any other given stock, their research can benefit from

looking into all of the Antero Midstream historical earnings in our data set presented side by side

on one page for ease of comparison. Reviewing this historical EPS information can help when projecting future earnings per share,

as well as providing important context for pondering whether the historical earnings trajectory justifies the current stock value or not.

That's why we bring you

HistoricalEarnings.com to make it more convenient for investors to look into

Antero Midstream historical earnings, or the historical earnings information for any stock in our coverage universe.

In your continued due diligence investigations, we hope you check out the further links included for historical PE studies, earnings

surprises history as well as next earnings dates for AM. Thanks for visiting, and the next

time you need to research

AM historical earnings or those of another stock, we hope our site will come to your mind

as your preferred historical earnings, revenue, and EPS research resource of choice.